snohomish property tax exemption

The following links maybe helpful. Use the search tool above to locate your property summary or pay your taxes online.

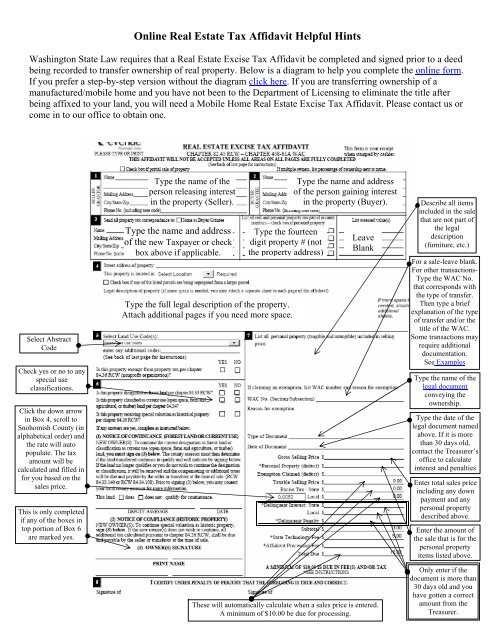

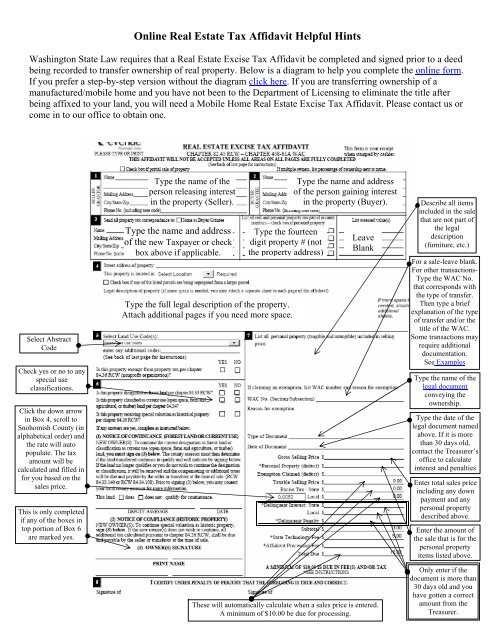

Online Real Estate Tax Affidavit Helpful Hints Snohomish County

CONTINUE THE EXEMPT STATUS OF THE PROPERTY AS OF THE DATE OF ACQUISITION BY.

. 8436020 CHURCH BUILDING USED FOR PUBLIC WORSHIP Exempt. Within those confines Snohomish establishes tax rates. LOT 6 BLK 7 SNOHOMISH CITY WESTERN PART ACCORDING TO THE PLAT THEROF RECORDED IN VOLUME 1 OF PLATS PAGE 3 RECORDS OF SNOHOMISH COUNTY WASHINGTON.

Seniors with net taxable income of 12000 or less on their combined taxpayer and spouse federal income tax return are exempt from all property taxes on their principal residence. Registration Number Parcel Number Location RCW Components Status Org Name Legal Description Parcel Comments. This home is currently off market - it last sold on August 15 1990 for 125000.

The Assessor and the Treasurer use the same software to record the value and the taxes due. The Exemption Division is responsible for the administration of various programs available to property owners to help reduce property taxes. 8436030 1 COMMUNITY SOCIAL SERVICE 8436043 TRANSITIONAL HOUSING.

Registration Number Parcel Number Location RCW Components Status Org Name. Registration Number Parcel Number. First the value of your residence is frozen for property tax purposes and you are exempt from all excess and special levies and Part 2 of the state school levy.

Over 7 days ago. Object moved to here. Under the exemption program your property taxes are reduced.

Nonprofit property tax exemption Export as CSV. 1215 Smithson Pl is a 1822 square foot house on a 8276 square foot lot with 3 bedrooms and 25 bathrooms. TGW THE N 115 FT OF LOT 5 BLK 7.

Please continue the exempt status of the property as of the date of acquisition by Applicant 112019. APPLICANT MUST SUBMIT APPLICATION TO TO THE DEPARTMENT OF REVENUE TO INCLUDE THIS PORTION OF THE PROPERTY INTO THE EXISTING LEASEHOLD EXEMPTION. This exemption program reduces your property taxes.

The property must not used by entities not eligible for a property tax exemption under chapter 8436 RCW for more than 50 days in the calendar year nor for financial gain or to promote business activities for more than 15 of those 50 days in the calendar year. First it reduces the amount of property taxes you are responsible for paying. Taxpayers rights to reasonable notice of rate increases are also required.

Senior Citizen Disabled Person Property Tax Deferral Program. Additional applications and instructions. For instance all homeowners age 65 or older are exempt from state property taxes.

Property Tax Exemptions This is a placeholder page for example purposes only. The exempt area is the 231 northern acres including the structures. Depending on your income you may also be exempt from a portion of the regular levies.

The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information. UNITED WAY OF SNOHOMISH COUNTY 3120 MCDOUGALL AVE STE 200 EVERETT WA 98201. Snohomish County Homestead Exemption For properties considered the primary residence of the taxpayer a homestead exemption may exist.

All property not exempted is required to be taxed equally and uniformly at current market worth. Based on Redfins Snohomish data we estimate the homes value is 738788. The property tax exemption for improvements to single-family dwellings is available for any.

King County property owners who pay their property taxes themselves rather than through a mortgage lender have until Monday November 2 to pay the second half of their 2020 bill. A copy of your drivers license or other approved. The exemption is available for a primary residence and one acre of land.

The taxable portion is the southern 347 acres. Nonprofit property tax exemption. Nonprofit property tax exemption Export as CSV.

Complete the application form for each year you wish to apply. You will not pay excess levies or Part 2 of the state school levy. If you apply for exemption in tax years prior to 2020 the income limit was 40000.

Second it freezes the. Personal property owned by the United Way of Snohomish County and located at 3120 McDougall Ave Suite 200 Everett WA. The Snohomish County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed resulting in a lower annual property tax rate for owner-occupied homes.

Nonprofit property tax exemption Export as CSV. Laws governing the property tax reduction were revised for the 2020 tax year Senate Bill 5160. Lydia House PO BOX 423 EVERETT WA 98206-0423.

The property tax exemption program benefits you in two ways. The Pierce and Snohomish county treasurers are also maintaining this deadline in their. Senior Citizen and Disabled Person Property Tax Exemption Application for taxes owed for 2016 through 2019 click on link to access the form.

Snohomish County Assessor 3000 Rockefeller Avenue Everett WA 98201 Phone. HARBOUR POINTE SECTOR 07 BUSINESS PARK BLK 000 D-00 - LOT 11. For the 2020 tax year forward the income limit increased to 55743.

Snohomish 188580000 4490000 Thurston 120021000 3429171 Total 4447840600 5753998 County Assessor Feedback During the data collection process county assessors responded to the following question. 230 MCRAE RD NE. Senior Citizen andor Disabled Persons.

See reviews photos directions phone numbers and more for Exemption Property Taxes locations in Snohomish WA. Records must be maintained listing the name of the groupperson using the facility. 3125 OAKES AVE EVERETT.

Snohomish County Property Tax Exemptions. After that date interest charges and penalties will be added to the tax bill. THIS APPLICANT WOULD BE EXEMPT FROM PROPERTY TAX IF THEY OWNED THE PROPERTY EFFECITVE MARCH 18 2013.

In addition depending on your income you may not need to pay a portion of the regular levies. 615 Cedar Avenue MARYSVILLE. BOYS GIRLS CLUBS OF SNOHOMISH COUNTY 8223 BROADWAY STE 100 EVERETT WA 98203.

Return the application with all required documentation including. EFFECTIVE 63005 SNOHOMISH COUNTY WORKFORCE DEVELOPMENT COUNCIL VACATED THAT TAXABLE LEASEHOLD PORTION DECRIBED AS 9993 SQ FT OF BLDG C-72 AS DESCRIBED ABOVE.

News Flash Snohomish County Wa Civicengage

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

Snohomish County Home Values Soar In Latest Assessment Heraldnet Com

News Flash Snohomish County Wa Civicengage

Snohomish County Snoh 64 0002 Fill Online Printable Fillable Blank Pdffiller

Area Briefly Snohomish County Tax Statement To Be Mailed Soon News Goskagit Com

Assessor Snohomish County Wa Official Website

Snohomish County Property Tax Exemptions Everett Helplink

Fillable Online Assessor Snoco Snohomish County Assessor Senior Exemption Form Fax Email Print Pdffiller

News Flash Snohomish County Wa Civicengage

General Tax Information Snohomish County Wa Official Website